Electronic Equipment Gst Rate

For example to find HS Code and tax rate for loading and unloading charges type. 12017-Integrated Tax Rate GSR.

Best Billing Machine Under 25000 Rupees In India Market Electronic Cash Register Billings Barcode Reader

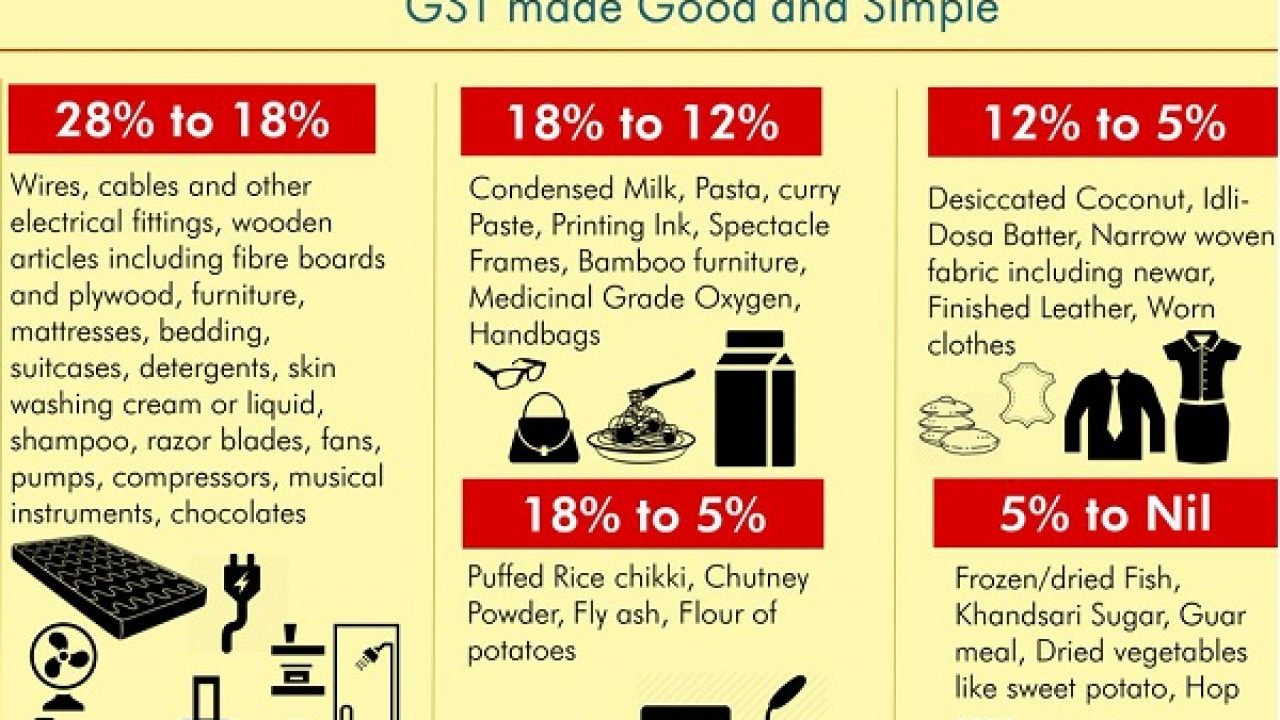

GST on toys mainly come under the three GST tax rate slabs which are 12 18 and 28.

Electronic equipment gst rate. Starting equipment used for spark or compression ignition of internal combustion engines such as spark plugs spark plugs starter motors and so on. You can use this very same form above to search HS Codes and tax rates for services also. Electrical Testing Equipment Insect Killer Insect Killer Machine Mosquito Racket Electrical Testing Equipment.

14th Nov 2017. The 28 GST rate is applicable to video games and its consoles. ELECTRICALELECTRONIC DEVICES FOR REPELLING INSECTS EGMOSQUITOES ETC Products include.

This category also includes festive. You can use this very same form above to search HS Codes and tax rates for services also. Moreover the deadline for submission of forms CMP-08 and CMP-02 were extended.

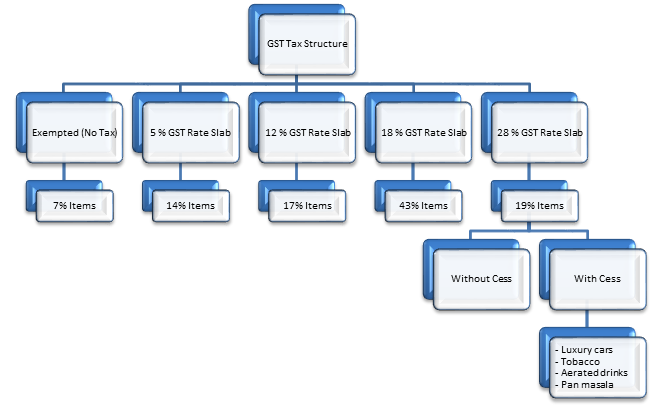

Optical Photographic Cinematographic Measuring. Gst rate schedule for electronics sector As per discussions in the GST Council Meetings held on 18052017 03062017 SlNo. GST Rate Schedule for Electronics Sector Hardware Extract from GST Rate Schedule as per GST Council Meetings held on 18th May 2017 and 03rd June 2017 37687 KB Extract from Revised GST Rate Schedule as per GST Council Meeting held on 11th June 2017 16272 KB.

Railway or Tramway Locomotives Rolling Stock Track Fixtures and Fittings. In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed. OTHER MOTOR WTH OUTPUT 375 W Products Include.

36th GST Council Meeting. Aircraft Spacecraft and Parts Thereof. IGST rate published vide Notification No.

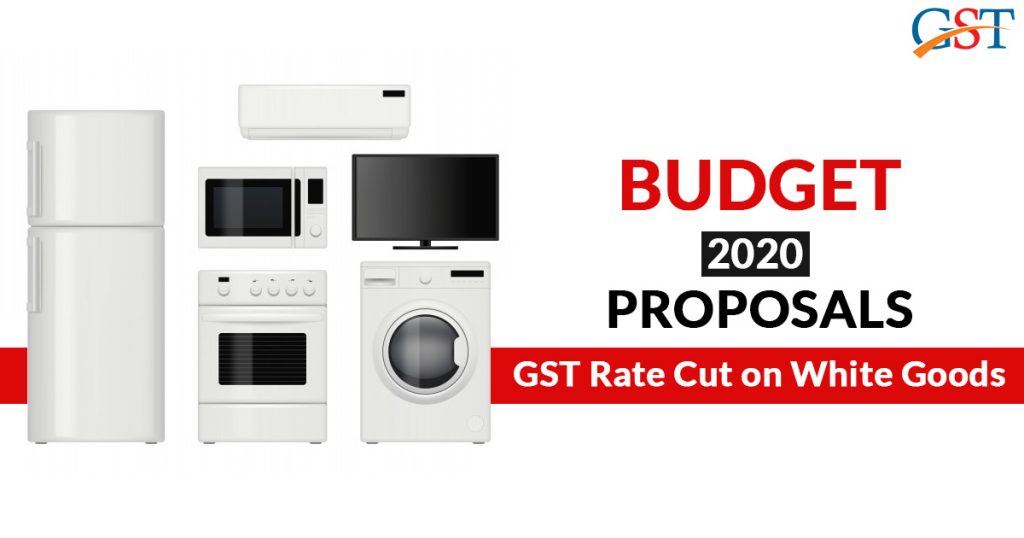

The 36 th GST Council Meeting held on 27 th July 2019 was primarily aimed to reduce GST rate on electric vehicles 12 to 5. 3020 4000 5000 3010 9000 1000 2010 8000 2090. For example to find HS Code and tax rate for loading and unloading charges type.

The GST rates on electric vehicle chargers and charging stations were also reduced to 5 from 12. In this GST Billing Software Training we will guide how to use Speed Plus for electronic stores. HS Code and tax rate for services.

Chapter Nil 5 12 18 28. The procedure to find HS Code with tax rate is very simple. 41 lignes Balances of a sensitivity of 5 cg or better with or without weights deleted.

For the purpose of this entry e-waste means electrical and electronic equipment listed in Schedule I of the E-Waste Management Rules 2016 published in the Gazette of India vide GSR. 338 E dated the 23rd March 2016 whole or in part if. 5 lignes GST Rate on Electronics.

666E dated 28062017 as amended by 32020-Integrated Tax Rate GSR. Type of Electronics Items. The procedure to find HS Code with tax rate is very simple.

Electrical Motors Electronic Items. Vehicles Other Than Railway or Tramway Rolling Stock. Ships Boats and Floating Structures.

64 lignes HSN Code GST Rate for Electrical and electronic products - Chapter 85. 338 E dated the 23rd March 2016 whole or in part if discarded as waste by the consumer or bulk consumer. Electrical Machinery and Equipment and Parts Telecommunications Equipment Sound Recorders Television Recorders.

The GST Council has broadly approved the GST rates for goods at 3 5 12 18 and 28 to be levied on certain goods. For the purpose of this entry e-waste means electrical and electronic equipment listed in Schedule I of the E-Waste Management Rules 2016 published in the Gazette of India vide GSR. Under GST Toys like tricycles scooters pedal cars excluding the electronic toys are taxed at 12 while the electronic toys including tricycles scooters pedal cars electronics are taxed at 18 GST.

Renewable energy electronic parts and. HS Code and tax rate for services. WIND POWERED Products Include.

Generators dynamos and alternators and cut-outs used alongside such engines. Electronic Item Products Include. The I ntegrated G oods and S ervices T ax ie.

In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed.

Gst Rate For Electrical Machinery Television

Gst Rate Slabs Simplified Kotak Bank

12 Gst Rate Items Hsn Code For Goods As On April 2020 Aubsp

Registration Under Goods And Service Tax Gst Goods And Services Goods And Service Tax Good Notes

Get To Know More About Transitional Rules Through Our Insights Goods And Service Tax Goods And Services Tax

Budget 2020 Proposals Gst Rate Cuts On White Goods Manufacturers Incentives For Local Makers

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Gst For It And Ites It Enabled Services Exceldatapro Tax Sales Tax Goods And Services

Get To Know More About Transitional Rules Through Our Insights Goods And Service Tax Goods And Services Tax

28 Gst Rate Items Hsn Code For Goods As On April 2020 Aubsp

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Gst Short Title Extent And Commencement Mcq On Multiple Choice Questions This Or That Questions Choice Questions Commencement

Gst Rate For Electronics Television And Audio Equipment Indiafilings

Gst Registration Process Types Benefits Enterslice Goods And Service Tax Goods And Services Legal Services

Place Of Supply Pos Under Goods And Services Tax Gst Goods And Services Goods And Service Tax Pos

List Of Gst Sections And Relevant Rules Goods And Service Tax Rules Goods And Services

Gst Provisions Change Is The Only Costant

Gst Refund Of Tax Mcq On Multiple Choice Questions Multiple Choice Choice Questions Refund

Post a Comment for "Electronic Equipment Gst Rate"