Electronic Funds Transfer Risk

Someone with a fake ID could collect the money without going through an extensive verification process. Electronic Funds Transfer Service.

17 Advantages And Disadvantages Of An Electronic Funds Transfer Vittana Org

These transfers take place independently from bank employees.

Electronic funds transfer risk. Consumers are especially wary of the possibilities of loss through EFTS transactions. The past thirty years have seen rapid advances in the technological component of banking services and as a consequence new legal issues have come to the fore especially with regard to Electronic Fund Transfers EFTs which are now used to transfer money around the world and have made fund transactions between payers and payees easier faster and more secure. ActAnti-Money Laundering Asset Quality Liquidity and Sensitivity to Market Risk.

What is Electronic Funds Transfer EFT Uses and Benefits. The electronic fund transfers include direct deposits. Either you can make a physical transfer usually in the form of cash or a cheque or you can send from your account to theirs the equivalent amount in electronic funds.

Management must decide either to lighten controls over funds transfer to an acceptable level of risk or accept the potential exposure to fraud and avoidable errors. EFT has become a predominant method of money transfer since it is a simple accessible and direct method of payment or transfer of funds. Some transactions that use this method are particularly risky such as wiring money to an office that pays proceeds in cash.

As a digital transaction there is no need for paper documents. Systems settlement fails liquidity risk. Authentication callbacks fax personal identification numbers.

A sequence number. Examiners reviewing Electronic Funds Transfer EFT have an opportunity to observe such things not all inclusive as suspicious activity loan participation activity borrowing activity brokered deposits and. The second way of transferring money is called an electronic funds transfer EFT and this guide will take you through everything you need to know about EFTs and the benefits of using them.

Electronic funds transfers Typically layers are created by moving money through electronic funds transfers into and out of domestic and offshore bank accounts of fictitious individuals and shell companies. The person or other source initiating the request. One participants failure to settle could deprive other participants of the funds they need to settle systemic risk.

Examination Modules 1020 The account title and number. European legislation therefore requires that specific information on payers and payees is passed on along the payment chain and that payment service providers have in place policies and procedures to ensure that this information is complete. Transfers of funds can be abused for terrorist financing and money laundering purposes.

The paper examined the numerous frauds that banks have sustained over the years in offering funds transfers services. Electronic Funds Transfer Risk Assessment Examination Start Date. For instance hackers operating through internet can access retrieve and use.

Examination Modules October 2000 Electronic Funds Transfer Risk Assessment Page. However there is a risk. First the criminal acquires the logon credentials of a legitimate funds transfer system user.

This typically happens two ways. Offshore banks These are banks that allow for the establishment of accounts from nonresident individuals and corporations. Unless you initiate an electronic funds transfer to pay yourself or transfer money between accounts there is no way to verify that the intended recipient got the cash.

Before widespread acceptance of the EPTS by consumers can occur consumer anxiety about EFTS must be reduced. The time and date. An electronic funds transfer EFT or direct deposit is a digital movement of money from one bank account to another.

Legitimate users visit ordinary-looking websites that plant malicious software on their computers. Or legitimate users may open innocent-looking email attachments that infect their computers with malicious software. In many instances banks have not just suffered financial losses but have also.

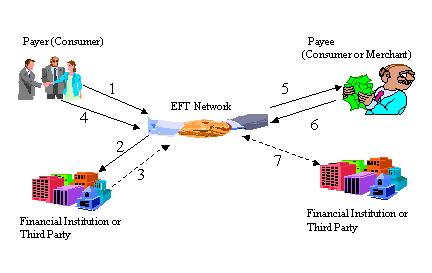

The amount to be transferred. An Electronic funds transfer is a financial transaction that takes place over a computer network. Electronic Funds Transfer Process When you use your card at a store money is electronically transferred from your account and then it is simultaneously deposited in the store account.

A number of countries have well-developed offshore. The method involves risks. To prevent such abuse payment service providers must be able to establish who sends and receives these funds.

The process allows customers to transfer funds between accounts within the same bank as well across different financial institutions. 03092001 Standards Associated Risks. Security refers to the protection of the integrity of EFT systems and their information from illegal or unauthorized access and use.

The problems associated with security in the electronic funds transfer systems EFTS have been the subject of much research and concern in the business community. Security risk arises on account of unauthorized access to a banks critical information stores like accounting system risk management system portfolio management system etc. A service involving any transfer of funds other than a transaction involving a paper instrument that is initiated through an electronic terminal telephone or computer and that orders or authorizes a financial institution to debit or credit an account Example.

Https Www Qls Com Au Getattachment 8da6d24f B756 4b10 8831 E807976328ab Qls Eft Guidelines June 2020 V5 Pdf

What Is A Wire Transfer How To Wire Transfer Money Eu Paymentz

How To Transfer Money For A Closing

What Is Electronic Funds Transfer Eft Payments Explained Ebanx

Electronic Fund Transfer Act Consumer Rights Protections

What You Need To Know About Eft Electronic Funds Transfer In Canada Apaylo Ecommerce Payment Software Canada

Ach Vs Wire Transfer Comparison Faqs Avidxchange

Moving Your Money Electronic Funds Transfer Forbes Advisor

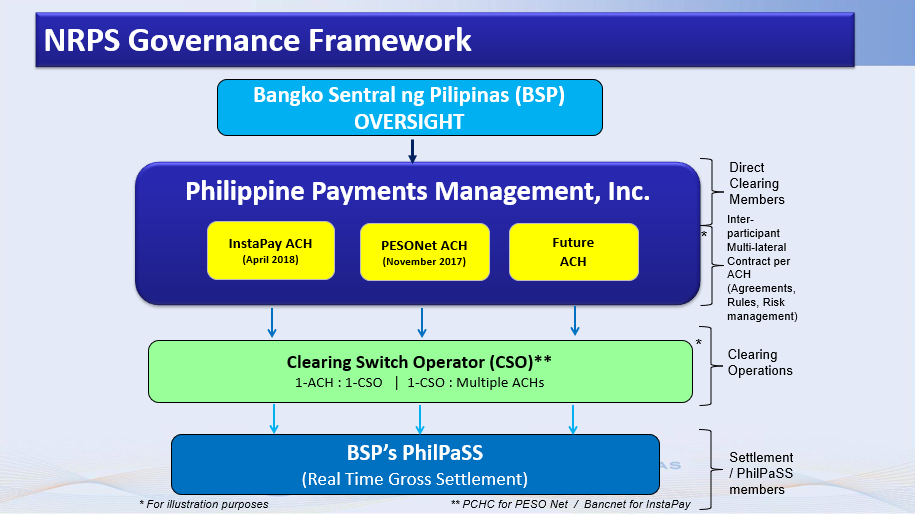

Payments And Settlements National Retail Payment System

Eft Payments The Ultimate Guide

Payment And Settlement Systems A Primer Vinod Kothari Consultants

Wire Transfer Vs Online Transfer Key Differentiators Remitr Blog

What Is Electronic Funds Transfer Eft Uses And Benefits Electronics Information Communications Technology

Eft Payments The Ultimate Guide

Ach Vs Wire Transfers What S The Difference Quickbooks

Neft What Is Neft Neft Timings Neft Transfer Daily Limits

Eft Payments The Ultimate Guide

Eft Payments The Ultimate Guide

:max_bytes(150000):strip_icc()/ElectronicFundTransferAdobeStock_91053116-912781d9ce5b406192b7704d0bd1e91f.jpeg)

Post a Comment for "Electronic Funds Transfer Risk"