Electronic Banking And Customer Satisfaction

Eng Lecturer Jomo Kenyatta University of Agriculture and Technology Kenya 2016 International Academic Journal of. It is believed that the electronic approach towards things should be started with customers first.

Pdf The Adoption Of Electronic Banking In Tunisia An Exploratory Study

This studys objectives were to.

Electronic banking and customer satisfaction. The researcher used questionnaires as the instrument for the data collection. Identify the Electronic banking services offered by GTB and its usage by customers To determine the impact of electronic- banking services on Customer Value. IMPEDIMENTS TO E-BANKING SERVICES MARKETING IN.

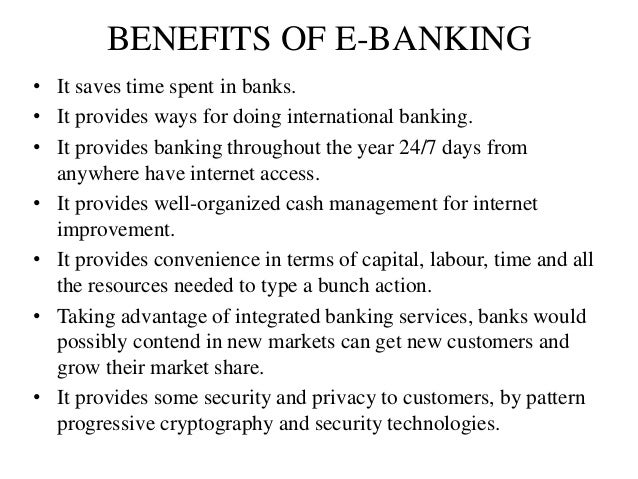

This study is on impact of electronic banking on customer satisfaction. A focus-shift from traditional banking to new service delivery channels is paramount among many banks to provide customers with 247 around-the-clock access to. Before the introduction of electronic bankingthe customer had simple things and a lot agree that because of the centricity of the banks it was more convenient back in the days of the traditional approach of banks.

Start Preparing to Run your CX Initiatives by AI Machine Learning Algorithms and Bots. The literature suggested that efficiency reliability security and privacy and responsiveness and communication are four important dimensions of customer satisfaction with E-Banking service quality. EFFECT OF ELECTRONIC BANKING ON CUSTOMER SATISFACTION IN SELECTED COMMERCIAL BANKS KENYA Victoria Tatu Simon Master of Business Administration in Strategic Management Jomo Kenyatta University of Agriculture and Technology Kenya Dr.

Gondar city Introduction Background of the study and the study area Customer satisfaction is a measure of how products and services supplied by a company meet or surpass customer expectation. THE IMPACTS OF ELECTRONIC BANKING ON CUSTOMER SATISFACTION IN TANZANIA BANKING INDUSTRY. A CASE STUDY OF NMB BANK DOREEN AKAD MCHOMBA A DISSERTATION SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTERS OF PROJECT MANAGEMENT OF THE OPEN UNIVERSITY OF.

However the study specifically seeks to. The general purpose of the study is to investigate the impact of electronic banking on customer satisfaction in Guarantee Trust bank plc. Descriptive Survey research design was adopted for this study.

Download Full PDF Package. A total of 133 respondents made are human resource managers accountants customer care managers and marketers. Customer satisfaction is also defined as the number of customers or.

37 Full PDFs related to this paper. Dashen and Wogagen banks. However the study specifically seeks to.

However the study specifically seeks to. ANALYSIS OF ELECTRONIC BANKING AND CUSTOMER SATISFACTION. According to Nochai Nochai 2013 Novickytė Pedroja 2015 high quality Internet banking can.

Thus customer satisfaction with electronic banking could be of signi cant importance. Identify the Electronic banking services offered by GTB and its usage by customers To determine the impact of electronic- banking services on Customer Value. Annonce Know What Defines Customer Experience Today And How Its Evolving Through The Year 2030.

Examine the effect of e-banking products on service quality and customer satisfaction and assess the challenges affecting e-banking and customer satisfaction. Null Hypotheses were raised in line with the objectives of the research. Introduction Today customers expect higher quality services from banks which if fulfilled could result in significantly improved customer satisfaction levels Ankit 2012The individual banks in the banking industry in Ghana are competing for customers and due to this banks have now become more.

The general purpose of the study is to investigate the impact of electronic banking on customer satisfaction in Guarantee Trust bank plc. Thus a survey was developed from prevalidated scales to assess the impact of the aforementioned dimensions on customer satisfaction. Annonce Know What Defines Customer Experience Today And How Its Evolving Through The Year 2030.

Identify the Electronic banking services offered by GTB and its usage by customers To determine the impact of electronic- banking services on Customer Value. The general purpose of the study is to investigate the impact of electronic banking on customer satisfaction in Guarantee Trust bank plc. Start Preparing to Run your CX Initiatives by AI Machine Learning Algorithms and Bots.

Customer Satisfaction Electronic Products Services Information Technology Bank 1. About electronic banking services and its impact on customer satisfaction at Sudanese banks. There is no significant relationship between e-banking.

A short summary of this paper. ANALYSIS OF ELECTRONIC BANKING AND CUSTOMER SATISFACTION. The study started in The study started in January 2017 and completed in December 2017.

The phase of the entire banking industry is rapidly changing in the 21st century. X-ray the effect of electronic banking on customer satisfaction in selected Nigerian Banks. The total population for the study is 200 staff of the GTB Edo state.

Http Www Ipedr Com Vol43 013 Icfme2012 M00033 Pdf

Document Scanning Services Document Scanning Company Electronic Signature Document Sign E Signature

Https Journals Sagepub Com Doi Pdf 10 1177 2158244018790633

Pdf The Effect Of Electronic Banking Products On Customer Satisfaction And Loyalty A Case Of Gcb Bank Ltd Koforidua Of Electronic Banking Products On Customer Satisfaction And Loyalty A Case Of Gcb

E Banking System Benefits And Challenges

Pdf Development Of Conceptual Framework For Internet Banking Customer Satisfaction Index

Summary Of Traditional And Electronic Banking Operations Capabilities Download Table

Pdf E Banking Services Features Challenges And Benefits Semantic Scholar

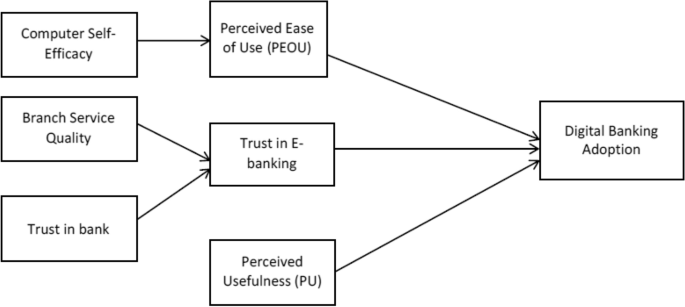

Adoption Of Digital Banking Channels In An Emerging Economy Exploring The Role Of In Branch Efforts Springerlink

Customer Satisfaction Towards E Banking Services Offered By Grin

Examining Factors Influencing E Banking Adoption Evidence From Bank Customers In Zambia

E Banking E Banking In India Types Of E Banking And Importance

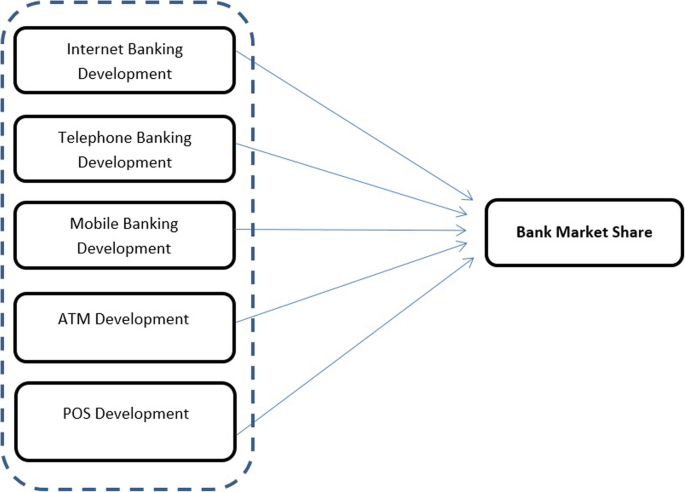

Development Of E Banking Channels And Market Share In Developing Countries Springerlink

Innovative Solutions For Banks Banking Mobile Banking Digital Transformation

Pdf Evaluation Of E Banking Dimensions By Greek Customers

Pdf Internet Banking Consumer Adoption And Customer Satisfaction

Pdf E Banking Services Features Challenges And Benefits Semantic Scholar

Pdf Perception Towards Adoption And Acceptance Of E Banking In Mauritius

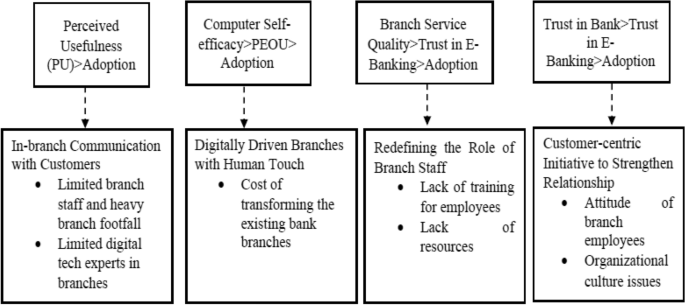

Adoption Of Digital Banking Channels In An Emerging Economy Exploring The Role Of In Branch Efforts Springerlink

Post a Comment for "Electronic Banking And Customer Satisfaction"