Electronic Identification And Remote Know-your-customer Processes

You must document the customer identification procedures you use for different types of customers. Know Your Business KYB process is not so different from the most widely known and standardized Know Your Customer KYC process.

What Is Kyc And Why It Is Important Complete Guide Revolut

Countering the financing of terrorism CFT and anti-money laundering AML define and.

Electronic identification and remote know-your-customer processes. Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers. Know Your Customer KYC procedures are a critical function to assess monitor customer risk a legal requirement to comply with AML laws. The uptake of disruptive technologies such as distributed ledger technologies and artificial intelligence may pose additional regulatory challenges.

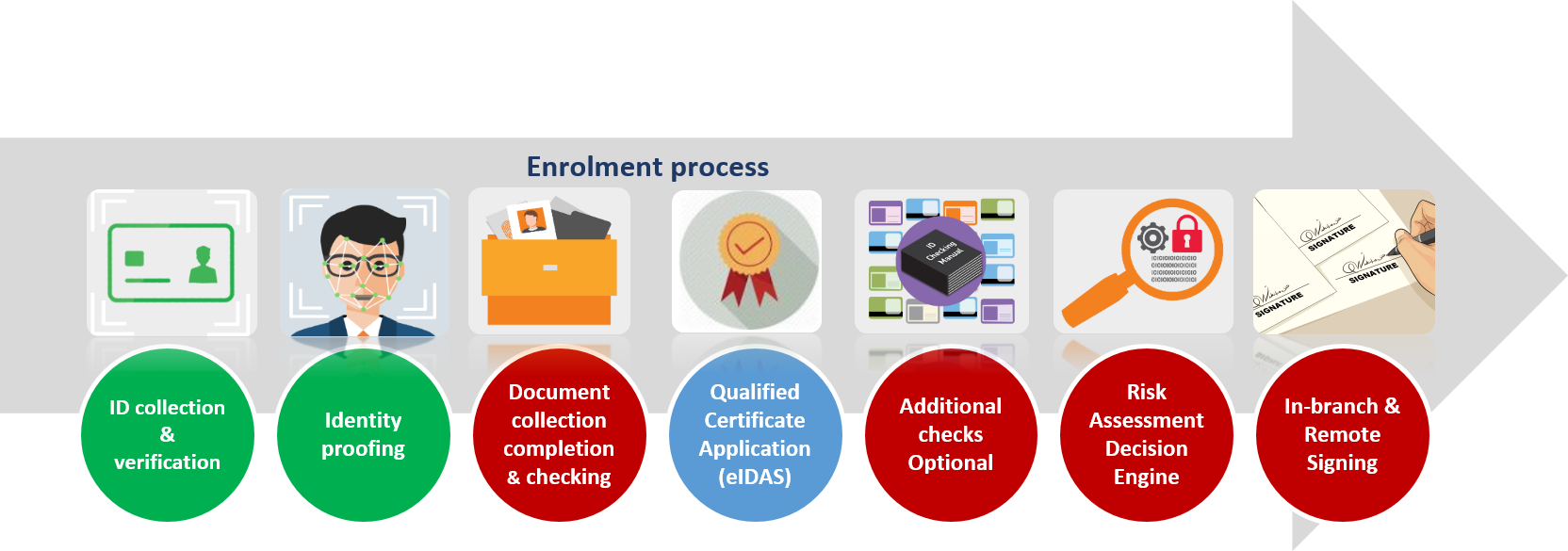

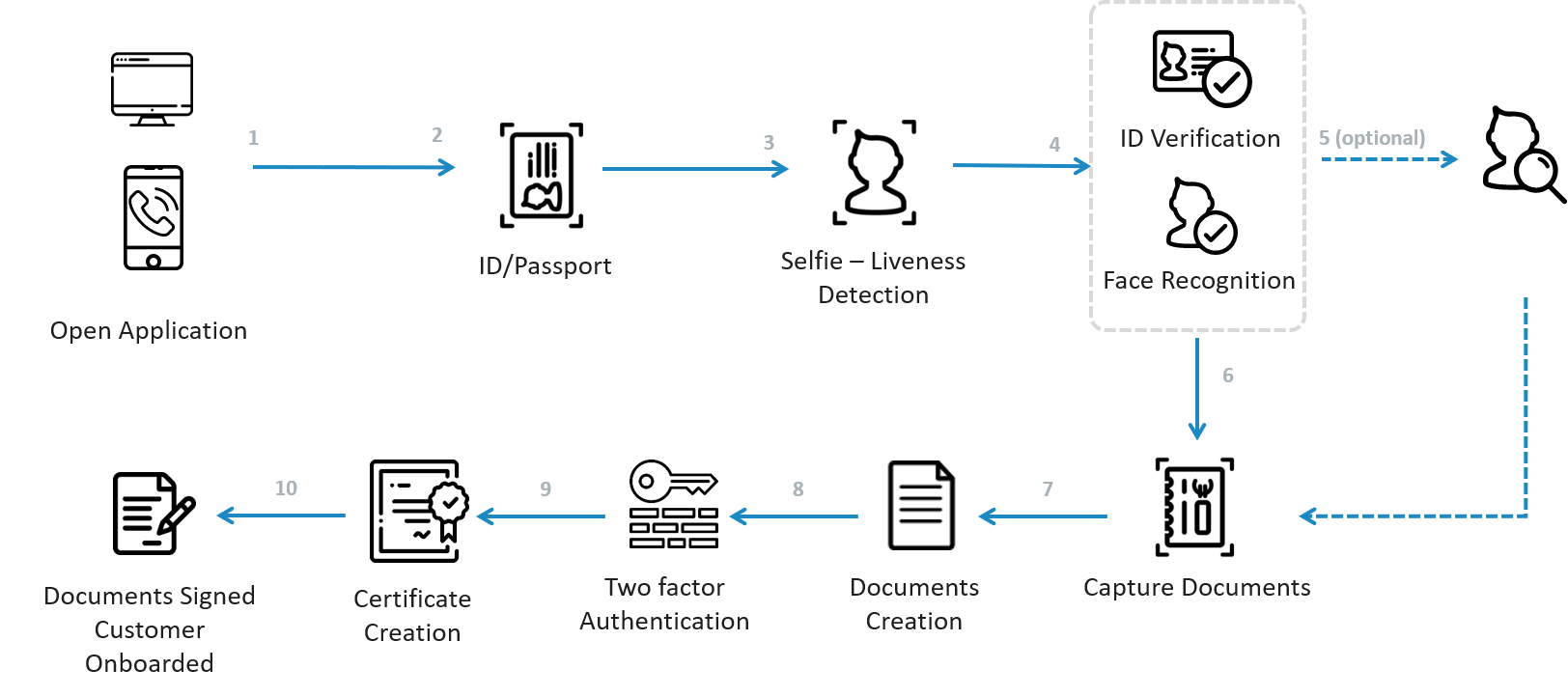

EKYC Electronic Know Your Customer is the remote paperless process that minimizes the costs and traditional bureaucracy necessary in KYC processes. Ce processus est le seul valable dans lUE. Une solution un seul processus pour tous vos canaux et filiales.

The AMLCTF Rules support flexible KYC processes and procedures. Leveraging Know-Your-Customer Processes with the Benefits of eIDAS-Electronic Identification GRIDS project Launched in April 2020 as part of the Connecting Europe Facility CEF program GRIDS seeks to facilitate the cross-border acceptance of e-identification and remote know-your-customer KYC processes. In this article you will discover why it is important its relationship with fraud the problems it has faced and how it is evolving.

Annonce Vous voulez identifier vos clients à distance. Ce processus est le seul valable dans lUE. Annonce Vous voulez identifier vos clients à distance.

While many reporting entities rely on electronic verification others use face-to-face or documentation based procedures. To facilitate the use of electronic identification and authentication the Commission set up a dedicated expert group on electronic identification and remote know-your-customer processes. Requirements for paper-based disclosure should be.

The difference lies in the purpose and intentionality of the process focused on identifying companies and suppliers in the first case and consumers or customers in the second one. As Australia responds to the COVID-19 pandemic we recognise that some know your customer KYC processes cannot be used. When a financial institution is unaware of certain details regarding its clients corrupt or illegal activity can easily slip under the radar.

As of Spring 2018 the expert group will explore how to facilitate the cross-border use of electronic identification eID and Know-Your-Customer KYC portability based on identification. In this article we will try to define and explain what Know Your Business is and. The entire identity verification procedure encompasses a lot however the most important ones are.

KYC Know Your Customer is today a significant element in the fight against financial crime and money laundering and customer identification is the most critical aspect as it is the first step to better perform in the other stages of the process. Verifying the identity of clients a practice known in financial circles as know your customer is absolutely essential for detecting money laundering. The EU electronic identification and trust services eIDAS regulation.

Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. Other ways that you can verify your customers identity and fulfil your. Know Your Customer or KYC is a vital customer identification tool that companies and financial institutions use during the customer onboarding process.

KYC Know Your Customer related practices are especially relevant in user and clients relationships with businessIt is the first step in a customer relationship with a company. Une solution un seul processus pour tous vos canaux et filiales. On 14 December 2017 the Commission Decision C2017 8405 final of 14122017 setting up the Commission expert group on electronic identification and remote Know-Your-Customer processes was adopted.

To explore how to facilitate the cross-border use of electronic identification eID and Know-Your-Customer KYC portability based on identification and authentication tools under Regulation EU No 9102014 of the European Parliament and of the Council on electronic identification and trust services for electronic transactions in the internal market eIDAS to enable financial institutions to identify. Do you know the three components of KYC. Falsification of identity signatures and phishing is very common.

Since its inception KYC has become a significant tool to fight financial crimes and cyberattacks. The global anti-money laundering AML and countering the financing of terrorism CFT landscape raise tremendous stakes for financial institutions. EKYC is the expression used to describe the digitalization and electronic and online conception of KYC processes.

Customer Identification Program CIP Customer due diligence. This guidance does not explain the practical ways. Ongoing monitoring This blog post highlights the importance of the KYC process followed by 3 steps to the KYC verification process.

Https Ec Europa Eu Info Sites Default Files Business Economy Euro Banking And Finance Documents Assessing Portable Kyc Cdd Solutions In The Banking Sector December2019 En Pdf

Seamless Sim Card Registration For Kyc Compliance Papersoft

Kyc Cryptocurrency Points To Remember Cryptocurrency Infographic Comic Book Writing

Https Ec Europa Eu Info Sites Default Files Business Economy Euro Banking And Finance Documents Assessing Portable Kyc Cdd Solutions In The Banking Sector December2019 En Pdf

Mellon Group Of Companies Psd2 Related Solutions

Mellon Group Of Companies Digital Solutions

Mellon Group Of Companies Digital Solutions

A Complete Guide To Understanding Kyc Compliance Regulations

Aml Compliance Checklist Best Practices For Anti Money Laundering

A Complete Guide To Understanding Kyc Compliance Regulations

Customer Due Diligence Ensuring That You Know Your Customer By Trulioo The Regtech Hub Medium

Know Your Customer Process In 3 Steps Hydrogen

Https Ec Europa Eu Info Sites Default Files Business Economy Euro Banking And Finance Documents Assessing Portable Kyc Cdd Solutions In The Banking Sector December2019 En Pdf

Top Ten Digital Marketing Agencies In Tanzania Banking Software Core Banking Digital Marketing Agency

A Complete Guide To Understanding Kyc Compliance Regulations

Seamless Sim Card Registration For Kyc Compliance Papersoft

What Is Kyc Know Your Customer And Its 2021 Status

A Complete Guide To Understanding Kyc Compliance Regulations

Https Ec Europa Eu Info Sites Default Files Business Economy Euro Banking And Finance Documents Assessing Portable Kyc Cdd Solutions In The Banking Sector December2019 En Pdf

Post a Comment for "Electronic Identification And Remote Know-your-customer Processes"